The Top Know Your Customer (KYC) Solutions For AML Compliance

Seamless, Secure, and Scalable KYC Software for the Entire Compliance Lifecycle

Instantly Verify Individuals Anywhere, Anytime.

The Best KYC Solutions for Fintech, Law Firms, VASPs, and Financial Services Providers

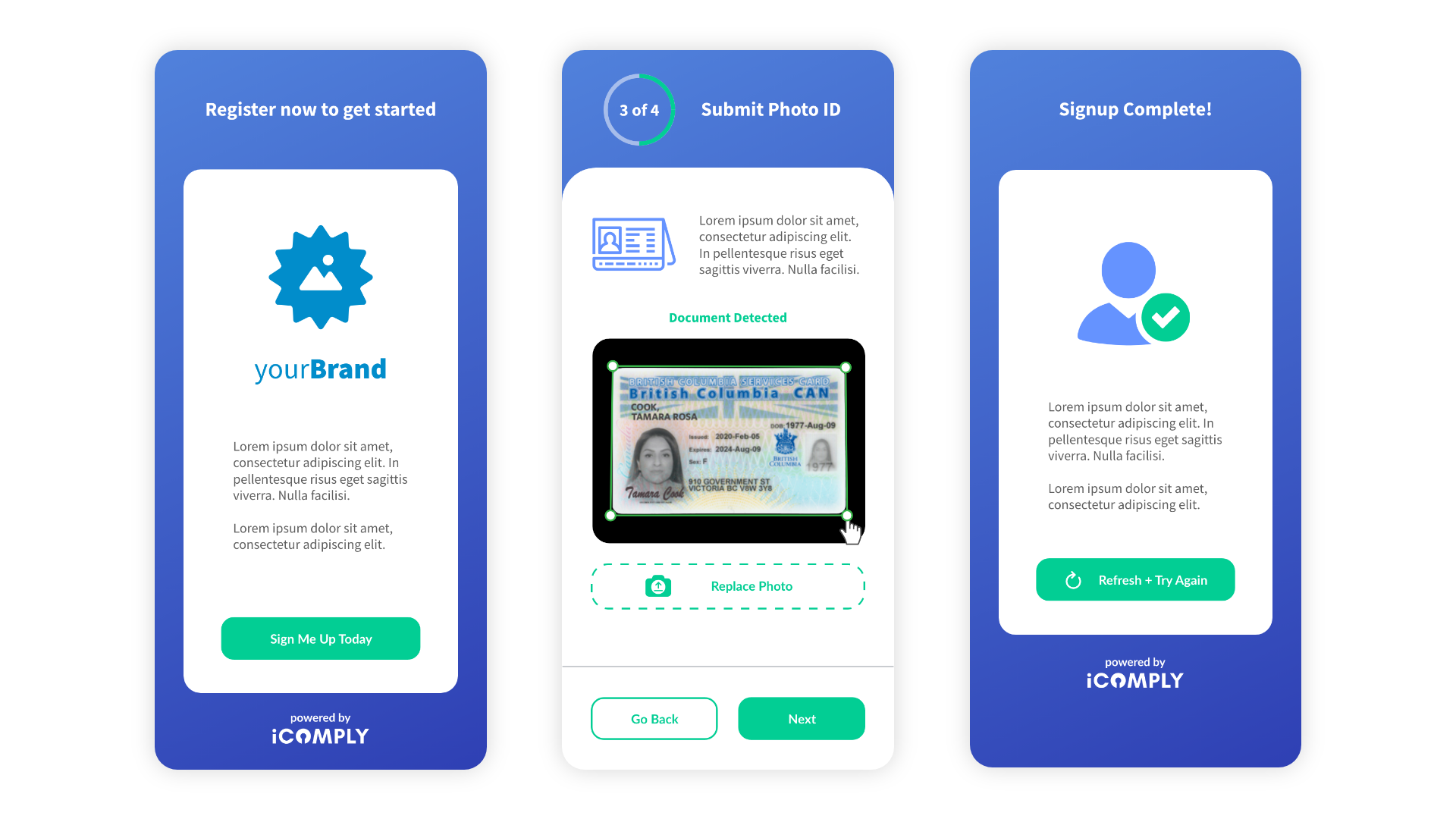

Onboard & Verifiy Individuals in Under 2 Minutes

Speed meets security with frictionless KYC verification and fully automated digital onboarding.

Automate KYC customer due diligence and audit logging. Configure our tools to match your KYC policies & procedures.

Click to Learn More

Authentic & Validate Photo IDs Instantly

Validate identity documents using machine vision and verify ID data with AI-powered OCR data extraction.

Catch expired IDs and identify fakes – including even the most sophisticated deep fakes and AI generated IDs.

Click to Learn More

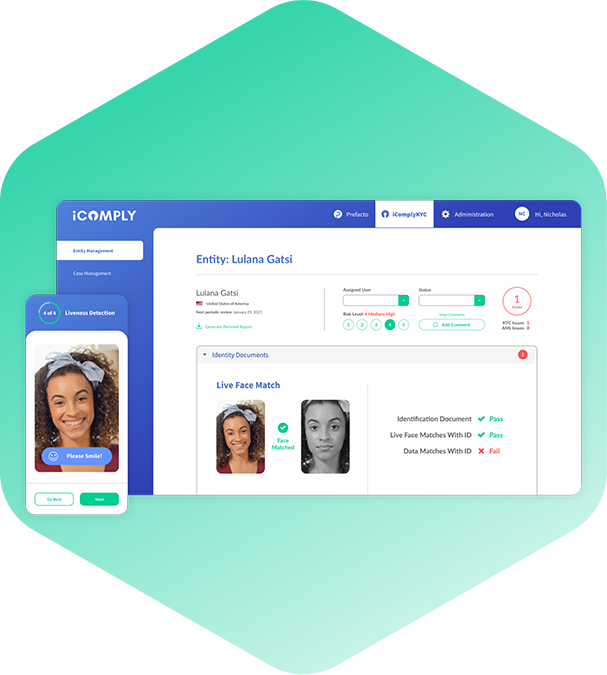

Match Faces to Documents With Live Biometrics

Confirm identity and user consent with active liveness detection and randomized, real-time face matching.

Instantly detect spoofing, man-in-the-middle and source code injection attacks – something no API vendor can deliver.

Click to Learn More

Secure KYC Document Collection Portals

Use customizable web forms, questionnaires, and KYC document collection portals

Designed to efficiently gather and encrypt KYC documents with the highest levels of security and privacy.

Click to Learn More

Pinpoint User Location With Absolute Precision

Enable geolocation-based controls to support jurisdictional compliance and advanced fraud prevention.

Access the user’s location services, device fingerprints, and IP address. Apply geo-fencing rules in real time.

Click to Learn More

Biometric Security Meets Multi-Factor Authentication

Strengthen access control with Multi-Factor Authentication (MFA) methods tailored to your client journey.

Choose from email, authenticator apps, biometrics, and more. Eliminate the need for physical presence.

Click to Learn More

Deliver Bulletproof Compliance With Audit-Ready KYC Reports

Capture, timestamp, and export every step of your process with complete audit trails and case logs.

Be prepared for internal reviews and regulatory audits with instantly accessible, documentation and reports on every entity, case, and transaction.

KYC at Scale With Automated Refreshes & Batch Processing

Run thousands of verifications simultaneously—ideal for high-volume KYC onboarding and KYC remediation.

Accelerate workflows without sacrificing accuracy or integrity. Upload a CSV or leverage REST APIs to import your KYC data for batch processing.

Remote Client Verification for Law Firms

Meet law society and bar association requirements by country with secure remote client verification.

Eliminate the need for physical presence while delivering FIU compliant, bank-grade identity assurance to any desktop or mobile application.

Integrations, Embedding, and Batch Processing

Embed your customer due diligence controls into any onboarding, KYC refresh, or KYC review flow.

Scale KYC compliance effortlessly with REST APIs and batch processing to adapt to your customer due diligence needs..

Click to Learn More

Secure KYC Compliance with Military-Grade Encryption

Protect all your customer KYC data and documents with AES-256 encryption and TLS 1.2 security.

Maintain data privacy, sovereignty, and regulatory compliance with our proprietary edge-processed encryption.

Click to Learn More

Unlock End-to-End KYC Compliance with iComply

One platform. One login. Total control over due diligence, screening, and monitoring operations.

Streamline your entire KYC compliance program with a single, AI-powered platform—built for leaders in compliance.

View Full Platform

It’s very easy to work with the KYC data. It helps to maintain, analyse, and draw insights from the data easily with no issues.

Still Chasing KYC Documents and Manual Reviews?

Book a demo today to learn how iComply can help you automate your entire KYC identity verification process and cut onboarding times by up to 90%.

Confidence in Your KYC Customer Due Diligence

iComply enables you to verify individuals quickly, accurately, and securely—reducing onboarding time while improving trust and compliance outcomes.

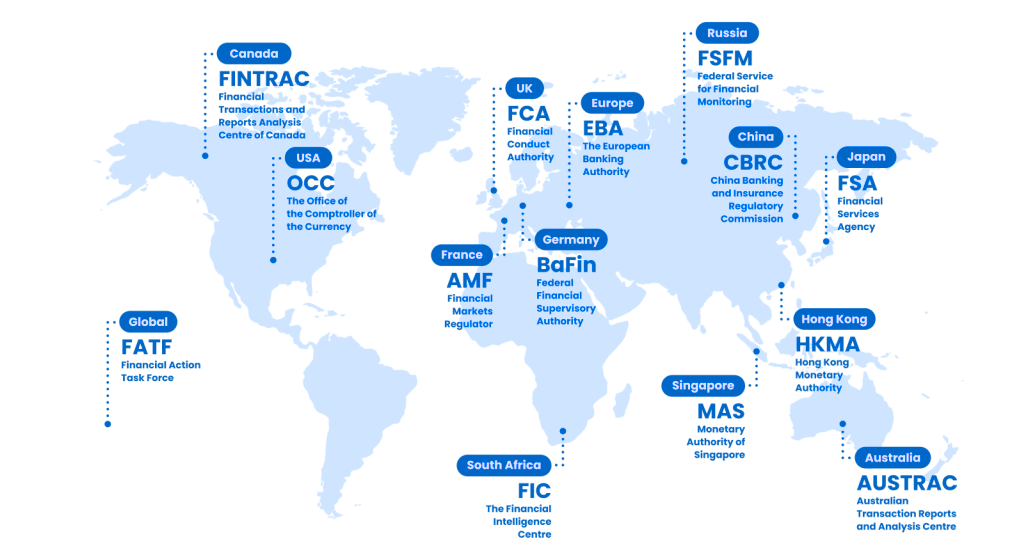

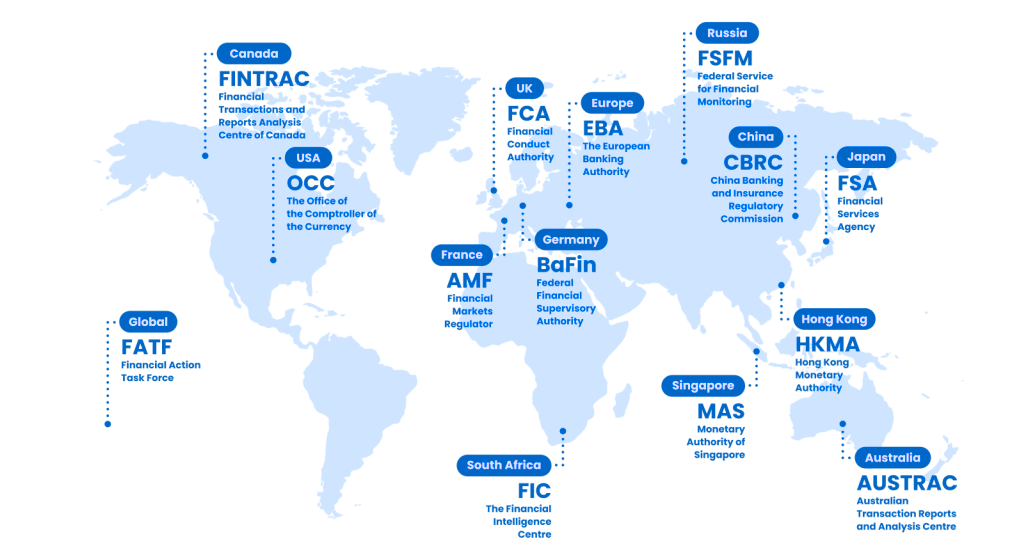

Our KYC verification tools use real-time identity checks, biometric verification, and document authentication to help you meet regulatory expectations across the FATF, EU AML Directives, FINCEN, FINTRAC, FCA, AUSTRAC, spanning 195 countries.

Build a complete, auditable profile for every client while reducing exposure to fraud, impersonation, and onboarding friction.

Efficiency That Drives Growth

From digital banks and fintech apps to law firms and financial services providers, iComply’s KYC platform delivers enterprise-grade identity verification that scales on demand. Batch processing and dynamic case management simplify operations at every level.

Our intelligent KYC automation cuts manual review, lowers false positives, and adapts to your internal workflows—so you can onboard more clients with fewer delays.

Whether you’re verifying hundreds or millions of clients each year, our KYC solutions power seamless KYC verification at scale. Validate and authenticate over 14,000 government issued photo identity documents locally in 195 countries.

Our Clients LOVE Our KYC Software Solutions!

See why growing teams and regulated institutions choose iComply to streamline onboarding, reduce fraud risk, and meet KYC obligations with confidence.

- Alt5 (NSDQ:ALTS) reduced onboarding time by 80%

- Timechain verified users across multiple markets with zero downtime

- A North American Neobank scaled to 50K+ users with under 2 minutes per verification

Read more about iComply’s intuitive KYC verification solutions and world-class customer support.

A Seamless, Scalable Experience

iComply’s KYC verification software supports global onboarding with localized workflows and multi-language support.

White-labeled portals, smart logic, and regulatory alignment are built in and easily configurable to future-proof your KYC compliance operations.

Stay agile, expand confidently, and deliver best-in-class user experiences across regions and product lines.

Start your free trial of iComply

Cancel Anytime. No Questions Asked.

Your Customers Are Global, Your KYC Software Should Be Too